by Mike McClaine

February 8, 2021

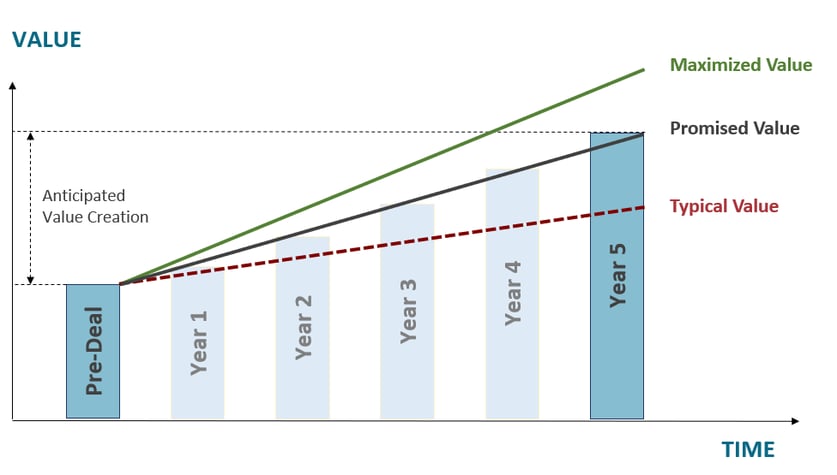

Imagine this scenario: The Visionary Products' shareholder meeting ends with the unanimous approval for acquiring NimbleBrands. It's a no-brainer; there is clear alignment on vison, the product lines are complementary, and there is organizational redundancy ripe for consolidation. On top of all that, Visionary’s leadership promises synergistic growth to the board and shareholders, but there is reason for concern: studies show that 70 to 90% of mergers and acquisitions do not achieve their promised value. The threat of The Leaky Bucket looms.

The M&A Leaky Bucket is the unexpected and often unexplained erosion of promised sales and profits over the course of an integration. The leaks are caused by a variety of factors, but often center around the high-pressure rush to results. Some of the most common contributing factors include the following:

The due diligence phase is short, and because of confidentiality and resource scarcity, teams are typically very small and at a senior level. That means that the people who know the reality of the business are often not even consulted. In addition, due diligence on the target side is problematic unless you know the right questions to ask. The challenge is understanding if that 20% growth rate is real, or if it has been propped up by short-term decisions to increase attractiveness for acquisition.

Pressure to get a deal done means the financials must work. Corporations typically have standard deal metrics that must be achieved to get board buy-off. These metrics can push the deal team to commit to financials that are a stretch at best. In addition, leaders can be overconfident in their own company’s capability and may underestimate the capability of a company being acquired, especially if that company is smaller and perceived as less sophisticated.

Technical transition is the most difficult part of the integration for executives to get their arms around, which often leads to underestimating costs. An IT leader recently provided a fitting example: “When both companies have the same enterprise software, leaders incorrectly assume that integration will be less complex and inexpensive… In reality, underlying deeper issues such as data and interfaces drive the cost and timeline.”

Technical transition applies to non-IT items as well. Aligning on business processes, compliance responsibilities, and even physical space is complex, time consuming, and expensive.

The integration program itself is where leadership often believes it can get a jump start: set up an integration team, develop plans, verify that risks and issues are mapped, and insist on a rapid escalation process. While it is important to ensure that execution is efficient, most companies intense focus on it is at the expense of attention on the M&A benefits. Value drivers are often not precisely identified or mapped to metrics, including KPIs that are lead indicators of success. Achieving full M&A value requires constant focus on the leading indicators, scenario planning, and quick reaction to ensure that sales and profits aren’t leaking.

Change management is the art and science of equipping the organization with what it needs to navigate from the current state to the ultimate vision. As leaders want to move rapidly from strategy to execution, the organization may not receive clear communication, knowledge, plans, and tools. The result is individuals are not completely bought into the change and engaged in producing the best results.

The biggest challenge of staffing an integration initiative is that the most important potential team members are critical to running the day-to-day business as well. Why? Because they best understand business operations and processes and know the informal communication networks that help get things done. In a resource constrained environment, employees with less capability than required are often staffed on integrations, or key employees are required to straddle both integration and operational roles. This choice creates strain and fails to set top employees up for success in either role.

One of the key missing elements in integration is culture alignment. Pre-deal analysis typically considers culture differences of both entities in a merger or acquisition. However, those cultural differences are often not adequately addressed. In addition, lack of clarity on which company’s strategies, processes, and systems will win the day can cause tremendous amounts of frustration and inefficiency. This is exacerbated as people feel the pressure of potential job loss or role changes.

Not surprisingly, the M&A Leaky Bucket is a challenge to corporations around the world. Proactively addressing these common causes can make a major impact on integration success.

Given the challenges the that integrations often present, how do we overcome the leaky bucket? Said in a more positive way, how do we maximize the value of the deal, and not only meet what was promised to the board, but exceed it?

Executives should adopt a mindset of truly understanding what is under the covers of an integration immediately. This means getting in the mindset of 2nd due diligence phase. What are the risks that could derail value? What are the issues that must be addressed to keep integration on plan? What are the opportunities to increase value to a greater level? This upfront effort can create the perception of lack of speed. However, understanding the real scope and key areas of focus will increase execution speed.

To enable success, of course, proper plans must be in place. However, just as important, the organization must be prepared and ready to engage in the change. It starts with transparent, realistic communication to the organization. People will not engage at their fullest level when they do not understand the impact that the change will have on them personally. In addition, do employees have the information, capabilities, and tools that they need for success?

After finalizing overall metrics for an integration, leaders should elevate the visibility of those KPIs that are core to achieving or exceeding the promised deal value. The next step is determining what the key value drivers are and their associated KPIs. The next level of analysis lets leadership understand the leading indicators that will show whether the value will be achieved or not. Having these leading indicators be visible to leadership prevents surprises down the road when it is too late to react.

Aspirant's M&A experts help clients navigate these pitfalls in order to streamline organizational integrations and maximize ROI. Use the form below to request a casual discussion about how they can do the same for you and your team.